It has been quite a while since I wrote a market update. I haven’t exactly been sitting around doing nothing but it is long overdue. A good bit of time lately has been assisting with care for Dad, who is doing fine. Then throw in a couple of quick trips to Argentina and Barcelona, and in my spare time I moved the office to a new location. Don’t get me wrong, everyday I spend time looking at charts and reading an enormous amount of material from various economist and money managers. Give me a call if you would like to stop by and see the new office and chat; I always love the company. Now back to the market….

The best way to summarize all the opinions on the market is with a quote I recently read…. ‘A man with one watch always knows what time it is; a man with two watches never knows what time it is’…. This due to the fact that no matter how precise, no two watches run the same. And so too the advice of market experts… no two ever agree completely. If you lock three economist in a room you will get four opinions.

It has been quite a ride since Trump’s election in November. We saw a surge of 8.9% in the S&P Nov 4 thru Dec 13. Then the market moved sideways until Feb 2 when it made another surge of 5% until Mar 1. As we entered the last month of this first quarter, the markets have become very “jittery” (technical term) and have given back half of the latest advance. A number of signals are flashing warnings that we are approaching a steep selloff while at the same time a number of analyst are saying ‘this is a buying opportunity.’ Below is a chart showing the S&P500 during this period.

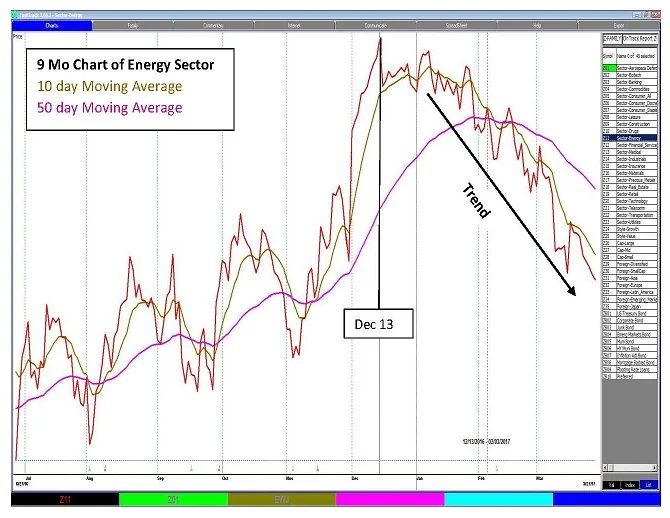

If we look at specific sectors of the market, we get conflicting indicators. For instance below is the Energy Sector showing a definite down trend with losses over 12% since mid December.

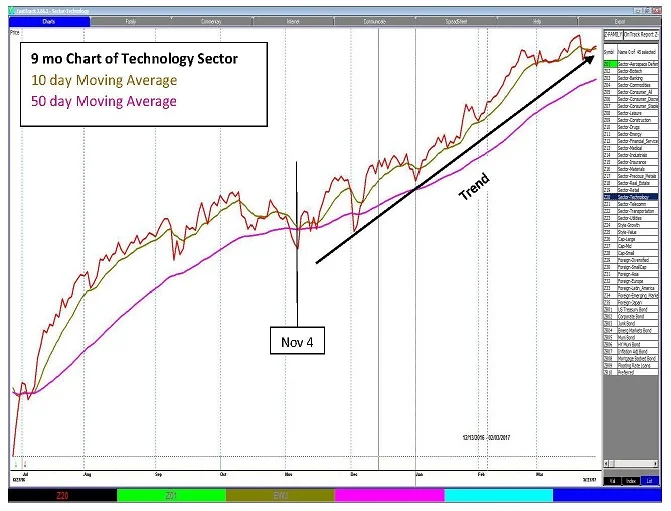

During that same time period, the Technology Sector is in a relatively low volatility uptrend, gaining 16% since Nov 4.

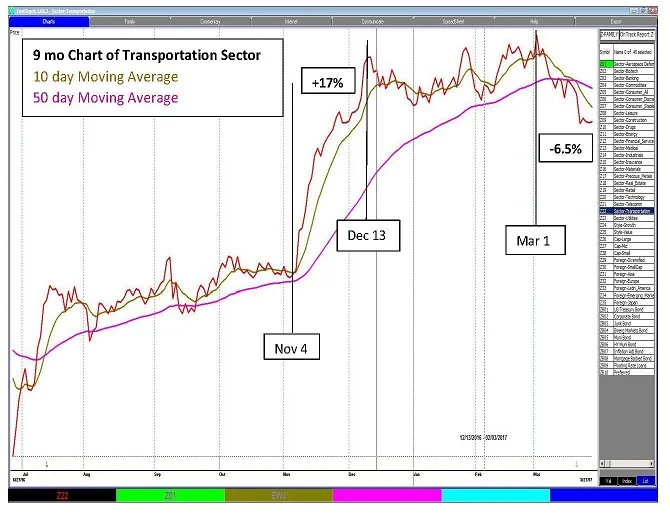

Transportation started out strong with a 17% increase, but has given back 30% of it’s gain or 6.5% since Mar 1.

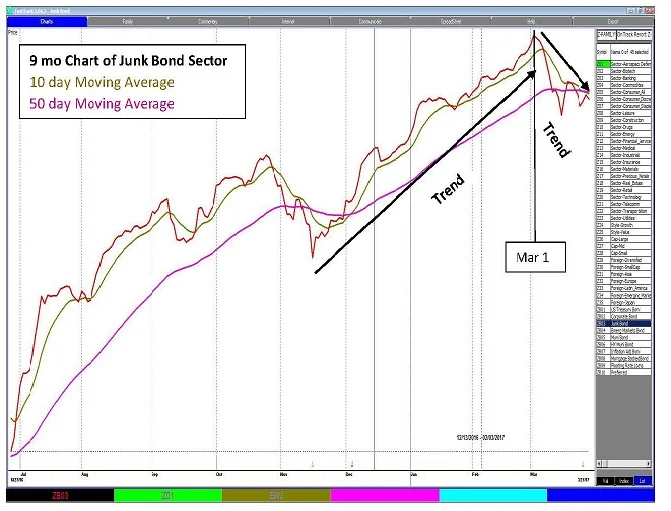

Junk Bonds tend to trend both up and down with relatively low volatility. They are often considered to be an early indicator of overall market condition. While they are not 100% right, they do provide us an indication of market conditions, often before they are evident in the broader market and therefore bear watching.

From the charts above, two things are certain. One, investors felt very confident after the surprising upset with the election of Trump. And two, market conditions changed on March 1. What lies ahead is impossible to predict, but we have to remain vigilant in looking for changes. Last week I started moving to cash positions as stops were hit and we are currently about 50% invested and 50% cash.

No one can predict what the markets will do next, but we can control risk. Anytime I purchase a fund for accounts, I have a stop or a sell-point in mind. It may be a certain price, a trend line or a moving average that when crossed, I will sell. This takes the emotion of trying to make a decision out of the equation. There are simple, straight forward rules that we apply. They don’t always mean there is an impending disaster but simply that the risk, at that point in time for that fund, warrant action. We may look back in a couple of weeks and say it was not necessary, but given what we know at that time, it is prudent to take action. If the market changes and continues its climb, we will get back in, but we will still have a sell point or stop in mind when we re-invest.

Everyone’s favorite time of year is fast approaching. No not baseball, though I am ready for a new season…. it is tax time. If you need copies of any statements or forms for your tax return, they are all available online through your account log on or please do not hesitate to send me a message or give a call. I can usually pull any information you might need and email it within a few hours.

As always, thank you for your continued trust and confidence. Please feel free to call or come by the new office. The view is nice ….. especially for Houston!!

Kirk Zickler