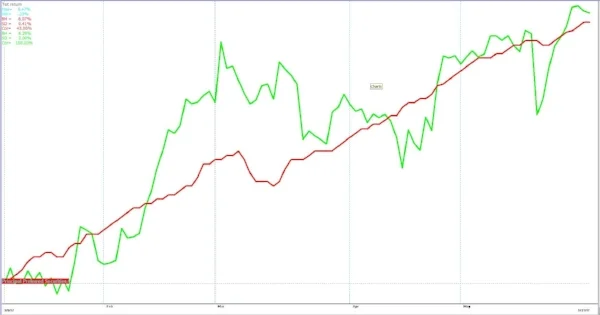

The market has enjoyed a relatively low volatility uptrend since the beginning of the year. Below is a chart since the beginning of the year showing the S&P500 in green and a Preferred Stock fund, PPSIX, in red. As you can see, they both achieve essentially the same result, but the red line has much lower day to day volatility.

Both are trending at slightly over 16% annualized return per year. The difference is that the S&P500 during this period experienced a standard deviation, the measure of volatility, of 2.0% while the standard deviation of PPSIX was only 0.41%. This is roughly 75% less volatile than the overall market as represented by the S&P500.

Fund selection is very important no matter what type of market environment we are in. I continually search for funds such as PPSIX that offer stable, low volatility opportunities.

It is important to also watch the fees that funds charge. In this case, PPSIX is an “I” share class fund and charges no load fees at purchase, but is only available thru Investment Advisors. The retail version of the same fund is PPSAX which is an “A” share class. The load fee at purchase of PPSAX is 3.75%. PPSAX also has a minimum investment of $1,000 and charges a slightly higher expense fee than PPSIX.

As investors it is important to realizea) that fund selection, not just sector selection, has a significant affect on your returns, but also b) which share class you choose. Two different investment funds may get to the same end point, but a less volatile fund insures that your money is available when you need it and it lets you sleep better at night. Advisors have many share classes available for various accounts that are not available to the general retail investor.

If you self manage your IRA, you may want to talk to an Advisor about opportunities you may be missing or fees that you may be paying unnecessarily.

We provide a no cost, no obligation review of your self-directed IRA holdings. If you are interested, please call the office to schedule a time to meet.